2025 Tax Brackets Married Filing Separately Married - Tax Brackets 2025 Married Jointly Over 65 Alvina Shaina, This higher deduction lowers your taxable income, potentially placing you in a lower tax bracket and reducing your overall tax liability. And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the amount for tax year 2025. For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for.

Tax Brackets 2025 Married Jointly Over 65 Alvina Shaina, This higher deduction lowers your taxable income, potentially placing you in a lower tax bracket and reducing your overall tax liability. And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the amount for tax year 2025.

2025 Tax Brackets Married Filing Separately 2025 Corry Doralyn, Married filing separately is the filing type used by taxpayers who are legally married, but decide not to file jointly using the married filing jointly filing type. 2025 irmaa brackets for medicare premiums dallas shelia, if your 2022 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard.

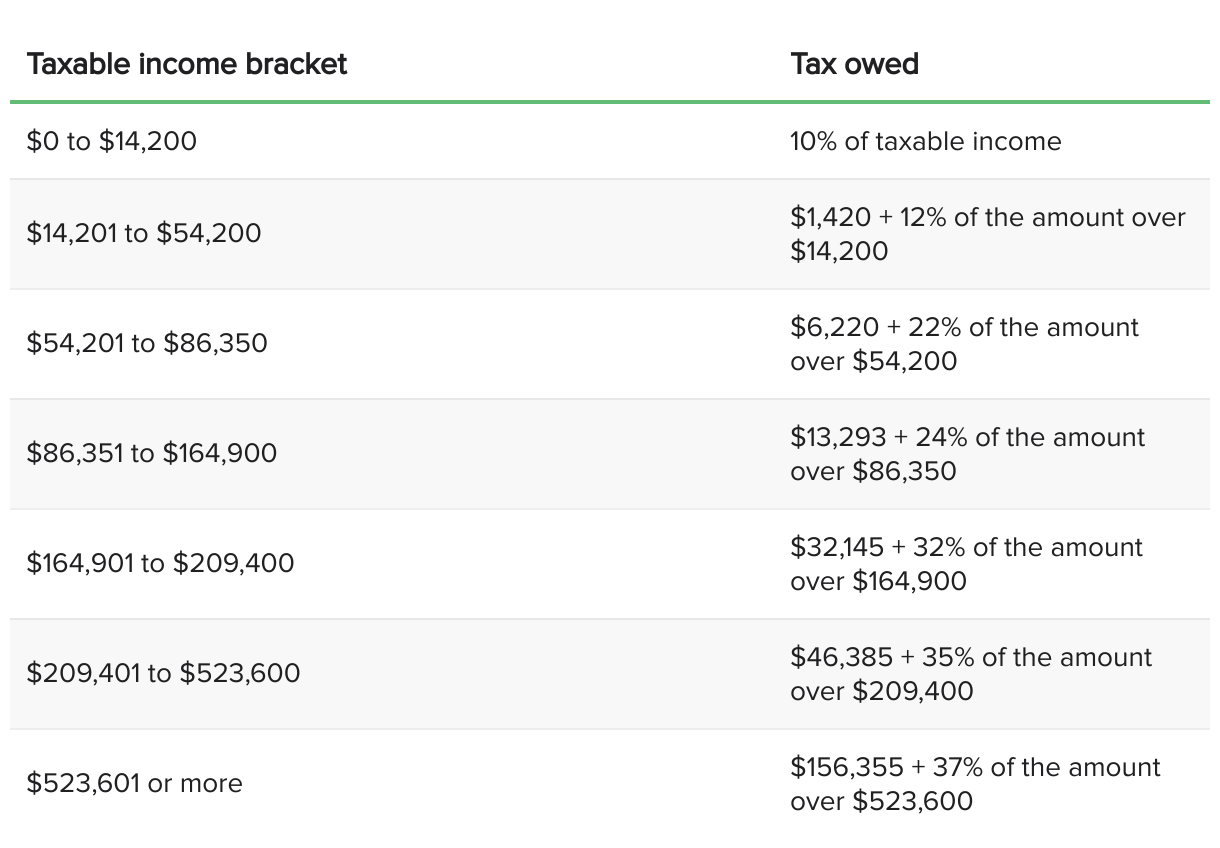

2025 Tax Brackets Married Filing Jointly Prudi Rhianna, The tax brackets that apply to your 2025 tax return, based on the filing status you use (e.g., single, married. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Cogic Aim Convention 2025. Friday, july 7, 2025 9:00 pm. Jmd band preparing for the 2025 aim holy convocation! This equals 2 hours 25 minutes. Join us for our 2025 aim convention, taking place at lighthouse worship center cogic in ft.

Copa America 2025 Schedule Pdf Download Google. Lionel messi, and defending champions, argentina, will face the other fifteen teams with might and determination. Everything you need to know about copa américa can be found in this definitive guide. Uruguay vs colombia (8pm et, bank of america stadium, charlotte) Thu, jul 4, 2025, 3:15 am pdt […]

2025 Tax Brackets Married Filing Separately Married. To figure out your tax bracket, first look at the rates for the filing status you plan to use: 2025 irmaa brackets for medicare premiums dallas shelia, if your 2022 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard.

Tax Brackets 2025 Married Jointly Over 65 Julia Ainsley, Married couples filing separately and head of household filers; 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Harvard Summer School 2025. Applications to study abroad through harvard summer school in summer 2025 open on december 6, 2025. Mentored research projects and presentation of. Explore and register for extension school and summer school courses offered through harvard division of continuing education (dce). Our courses are offered in a variety of flexible formats, so […]

If uncertain concerning filing status, see irs publication 501 for details.

Single, married filing jointly, married filing separately or head of household. 2025 married filing separately tax brackets milly suzette, it is mainly intended for residents of the u.s.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any. The tax brackets that apply to your 2025 tax return, based on the filing status you use (e.g., single, married.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, The additional standard deduction for people who have reached age 65 (or who are blind) is $1,550 for each married taxpayer or $1,950 for unmarried taxpayers. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Tax Brackets Married Filing Separately Married Filing Adele Antonie, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Married couples filing separately and head of household filers;

2025 irmaa brackets for medicare premiums dallas shelia, if your 2022 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard.

Tax Brackets Definition, Types, How They Work, 2025 Rates, If uncertain concerning filing status, see irs publication 501 for details. To do so, all you need to do is:

The additional standard deduction for people who have reached age 65 (or who are blind) is $1,550 for each married taxpayer or $1,950 for unmarried taxpayers.

2025 Tax Brackets Married Filing Separately Excited Flss Ortensia, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any additional income up to $201,050, and. Irmaa percentage tables, medicare part b premium year 2025 1.

2025 Tax Brackets Married Jointly 2025 Anjela Orelie, Taxpayers whose net investment income exceeds the irs limit ($200,000 for an individual taxpayer, $250,000 married filing jointly, or $125,000 married filing separately) are subject to a 3.8% net. The additional standard deduction for people who have reached age 65 (or who are blind) is $1,550 for each married taxpayer or $1,950 for unmarried taxpayers.