Max Social Security Withholding 2025 - What Is My Full Retirement Age for Maximum Social Security?, At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907. At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907. How To Fix Social Security Forbes Advisor, If you are working, there is a limit on the amount of your earnings that is taxed by social security. People whose earnings equaled or exceeded social security’s maximum taxable income — the amount of your earnings on.

What Is My Full Retirement Age for Maximum Social Security?, At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907. At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907.

This amount is known as the “maximum taxable earnings” and changes each.

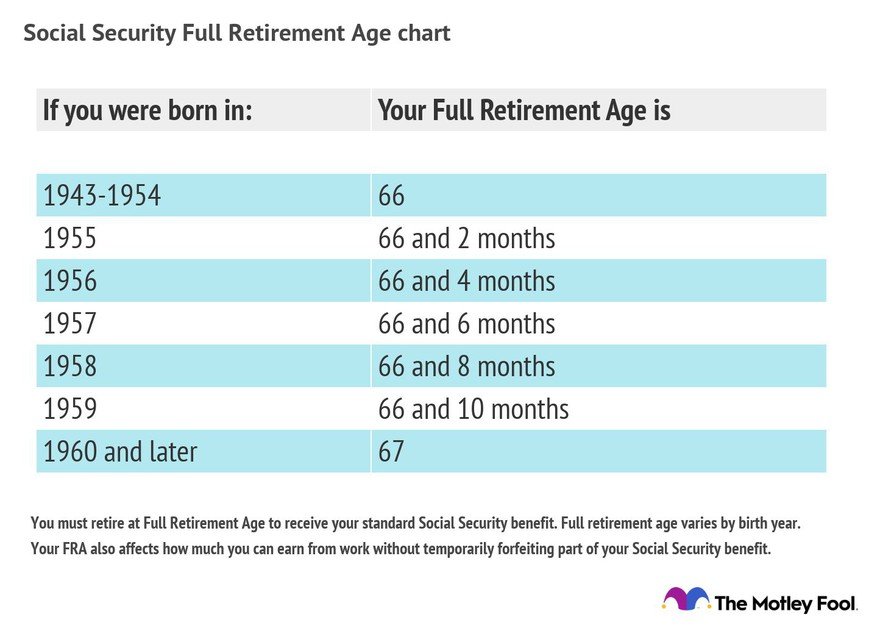

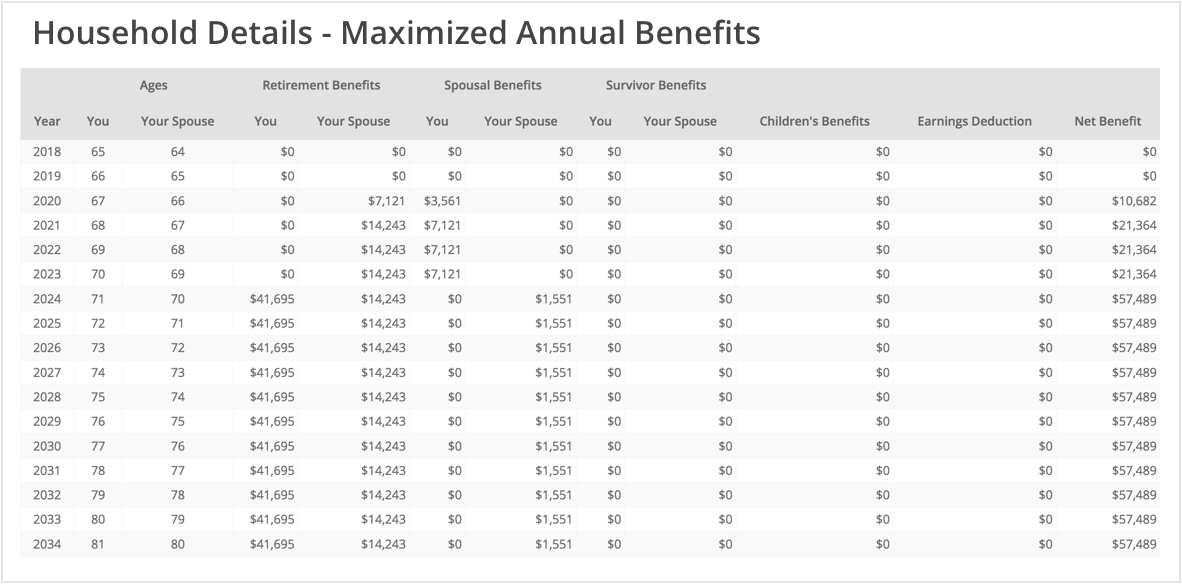

How Maximize My Social Security Works Maximize My Social Security, If you are working, there is a limit on the amount of your earnings that is taxed by social security. If you retire at your full retirement age (fra) this year, your.

Limit For Maximum Social Security Tax 2022 Financial Samurai, For 2025, the social security tax limit is $168,600. If you prefer not to have taxes deducted from your monthly.

1, 2022, the maximum earnings subject to the social security payroll tax will increase by $4,200 to $147,000—up from the $142,800 maximum for.

30+ Social Security Statistics [2025] Average Social Security Benefit, In 2025, the social security tax limit rises to $168,600. At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907.

![30+ Social Security Statistics [2025] Average Social Security Benefit](https://www.zippia.com/wp-content/uploads/2022/05/how-much-us-gdp-is-social-security.png)

That’s a $59 monthly increase before accounting. At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907.

Policy Basics Top Ten Facts about Social Security Center on Budget, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The social security administration (ssa) has announced that the maximum earnings subject to social security tax (social security wage base) will increase from.

Max Social Security Withholding 2025. (for 2025, the tax limit was $160,200. This amount is known as the “maximum taxable earnings” and changes each.

The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

Maximum Taxable Amount For Social Security Tax (FICA), The maximum benefit depends on the age you retire. The maximum amount of social security tax an employee will have withheld from.

Maximum Taxable Amount For Social Security Tax (FICA), What is the maximum social security retirement benefit payable? At the start of 2025, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907.

81 Years of Social Security's Maximum Taxable Earnings in 1 Chart The, Who is eligible for the maximum benefit? The limit on annual earnings subject to social security taxes is referred to as the taxable maximum or the social security tax cap.

Withholding Taxes From Social Security Kiplinger, That's a $59 monthly increase before accounting. In 2025, the social security tax limit rises to $168,600.